Financial Highlights

Operating Results

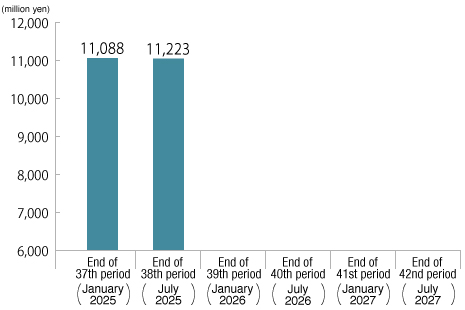

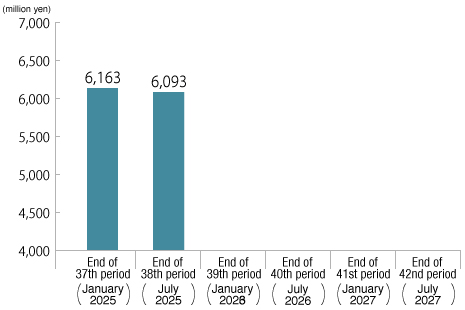

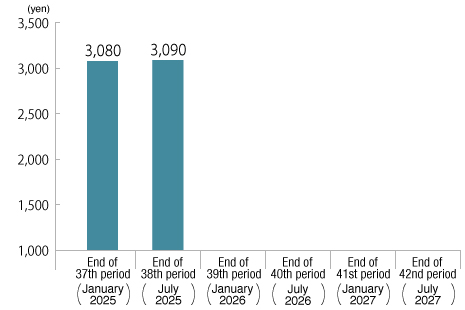

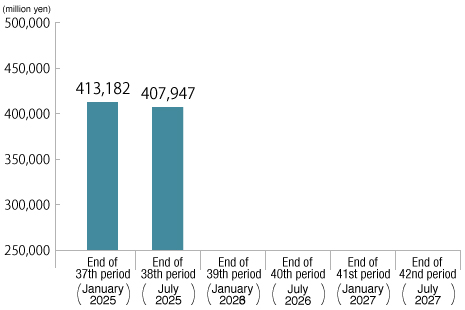

37th fiscal period (January 2025)-42nd fiscal period (July 2027)

Operating revenues

Net income

Dividend per unit

※A 5-for 1 split of investment units was implemented on February 1, 2014.

Total assets

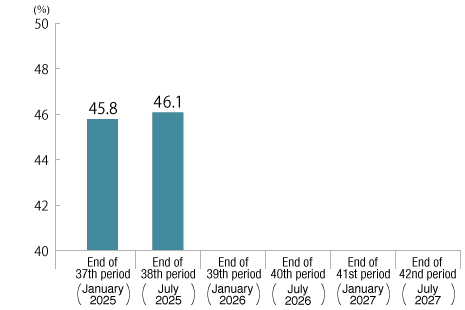

LTV (book value basis)

Change in Financial Highlights (Excel: 35KB)

- (Note)

- Net income per unit for the periods with capital increase are calculated based on the average number of investment units during the period.

Diversification of borrowing maturities

Diversification of borrowing maturities