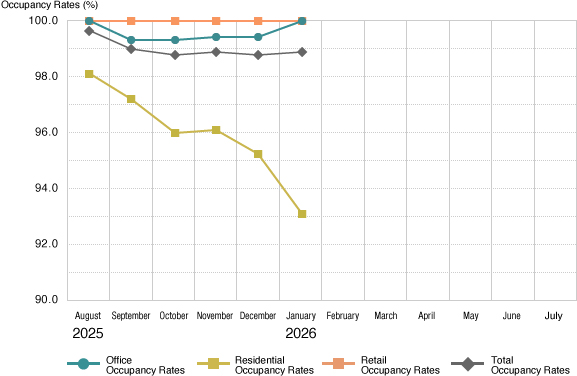

Trend in Occupancy Rates

Trend in Occupancy Rates

39th fiscal period (January 2026) ・40th fiscal period (July 2026)

Detail of Occupancy Rates

39th fiscal period

(January 2026) |

August

2025

|

September |

October |

November |

December |

January

2026

|

Occupancy

rates

(%) |

Office |

100.0 |

99.3 |

99.3 |

99.4 |

99.4 |

100.0 |

| Residential |

98.1 |

97.2 |

96.0 |

96.1 |

95.2 |

93.1 |

| Retail |

100.0 |

100.0 |

100.0 |

100.0 |

100.0 |

100.0 |

| Total |

99.7 |

99.0 |

98.8 |

98.9 |

98.8 |

98.9 |

Total

leasable

floor

area

(㎡) |

Office |

147,196.59 |

147,196.59 |

147,196.59

|

147,196.59

|

150,102.35 |

150,102.35

|

| Residential |

28,544.02 |

28,544.02 |

28,544.02

|

28,544.02

|

28,544.02 |

28,544.02

|

| Retail |

6,914.91 |

6,914.91 |

6,914.91

|

6,914.91

|

6,735.36 |

6,735.36

|

| Total |

182,655.52 |

182,655.52 |

182,655.52

|

182,655.52

|

185,381.73 |

185,381.73

|

40th fiscal period

(July 2026) |

February

2026

|

March |

April |

May |

June |

July

|

Occupancy

rates

(%) |

Office |

|

|

|

|

|

|

| Residential |

|

|

|

|

|

|

| Retail |

|

|

|

|

|

|

| Total |

|

|

|

|

|

|

Total

leasable

floor

area

(㎡) |

Office |

|

|

|

|

|

|

| Residential |

|

|

|

|

|

|

| Retail |

|

|

|

|

|

|

| Total |

|

|

|

|

|

|

- (Note 1)

- Rentable floor space is rounded to the one-hundredth decimal point. For real estate or property, rentable floor space is calculated by multiplying MHR's ownership by the entire building's rentable floor area. The occupancy rates are rounded to the one-tenth decimal point.

- (Note 2)

- The method for calculating occupancy rates has been changed from the 11th period as follows:

[With respect to complex, mixed use properties with both office and residential components]

Office Component → Square meters used as office are categorized as “Office”

Residential Components → Square meters used as residential are categorized as “Residential”